Compare New India Assura with Similar Stocks

Stock DNA

Insurance

INR 24,877 Cr (Small Cap)

21.00

22

1.22%

0.00

4.03%

0.85

Total Returns (Price + Dividend)

Latest dividend: 1.8 per share ex-dividend date: Sep-04-2025

Risk Adjusted Returns v/s

Returns Beta

News

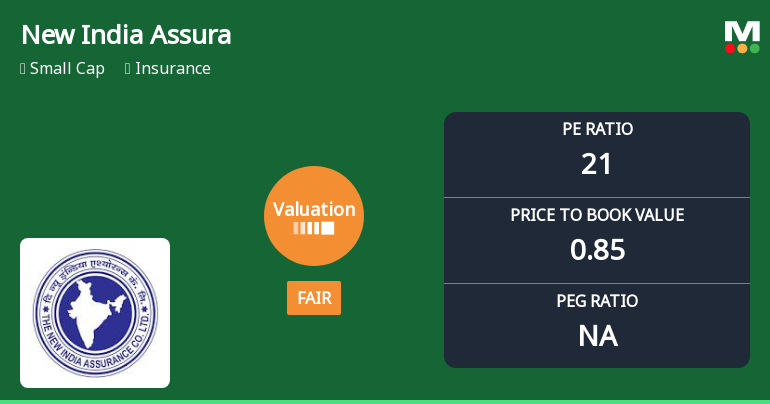

New India Assurance Valuation Shifts to Fair Amid Sector Pressure

New India Assurance Company Ltd has experienced a notable shift in its valuation parameters, moving from an expensive to a fair valuation territory. This change, reflected in its price-to-earnings (P/E) and price-to-book value (P/BV) ratios, suggests a more attractive entry point for investors amid a challenging insurance sector landscape.

Read full news articleAre New India Assurance Company Ltd latest results good or bad?

The latest financial results for New India Assurance Company Ltd reveal a complex operational landscape characterized by significant challenges despite some positive trends in premium income. In Q3 FY26, the company reported a consolidated net profit of ₹54.06 crore, reflecting a notable contraction of 86.50% quarter-on-quarter and 39.73% year-on-year. This decline is attributed to rising employee costs, which more than doubled from the previous quarter, and a sharp drop in other income, which turned negative at ₹-107.78 crore. On the revenue side, net premium income showed robust growth, increasing by 14.77% quarter-on-quarter and 24.70% year-on-year to reach ₹13,449.68 crore. This indicates strong business momentum; however, it has not translated into profitability, as evidenced by the operating margin, which fell to 1.39%, down from 2.01% in the previous quarter. The nine-month performance for FY26 pre...

Read full news article

New India Assurance Company Ltd is Rated Sell

New India Assurance Company Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 03 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Investor Presentation

03-Feb-2026 | Source : BSEThe revised Investor presentation for Quarter ended 31.12.2025 has been attached.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

02-Feb-2026 | Source : BSEThe recording link of the Investor meet has been uploaded on the Stock Exchanges.

Announcement under Regulation 30 (LODR)-Investor Presentation

02-Feb-2026 | Source : BSERevised Investor Presentation for the Quarter ending 31st December 2026

Corporate Actions

No Upcoming Board Meetings

New India Assurance Company Ltd has declared 36% dividend, ex-date: 04 Sep 25

No Splits history available

New India Assurance Company Ltd has announced 1:1 bonus issue, ex-date: 27 Jun 18

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 20 Schemes (0.08%)

Held by 56 FIIs (1.0%)

Government Of India In The Name Of President Of India (85.44%)

Life Insurance Corporation Of India (8.67%)

2.06%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 12.77% vs -5.83% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 8.85% vs -51.62% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 18.70% vs 3.60% in Sep 2024

Growth in half year ended Sep 2025 is 38.10% vs 291.24% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 16.71% vs 0.23% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 23.04% vs -15.83% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 0.12% vs 6.34% in Mar 2024

YoY Growth in year ended Mar 2025 is -7.15% vs 6.53% in Mar 2024