Compare Subex with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -167.83% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 0.38

- The company has been able to generate a Return on Equity (avg) of 1.65% signifying low profitability per unit of shareholders funds

Risky - Negative EBITDA

Despite the size of the company, domestic mutual funds hold only 0% of the company

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Software Products

INR 557 Cr (Micro Cap)

NA (Loss Making)

27

0.00%

-0.30

-1.61%

1.70

Total Returns (Price + Dividend)

Latest dividend: 0.25 per share ex-dividend date: Jul-01-2021

Risk Adjusted Returns v/s

Returns Beta

News

Subex Ltd is Rated Strong Sell

Subex Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 13 January 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 04 February 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article

Subex Ltd Technical Momentum Shifts Amid Bearish Market Sentiment

Subex Ltd, a key player in the Software Products sector, has experienced a nuanced shift in its technical momentum, moving from a bearish stance to a mildly bearish trend. Despite a modest day gain of 2.09%, the stock’s broader technical indicators present a complex picture, with mixed signals from MACD, RSI, moving averages, and other momentum oscillators. This article analyses these technical parameters in detail, placing Subex’s performance in the context of its sector and the broader market.

Read full news article

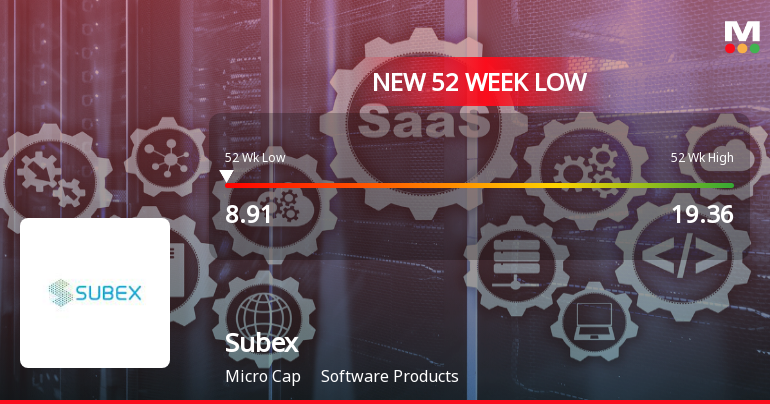

Subex Ltd Stock Falls to 52-Week Low of Rs.9 Amidst Continued Downtrend

Subex Ltd, a player in the Software Products sector, touched a new 52-week low of Rs.9 today, marking a significant decline amid ongoing market pressures and company-specific factors. The stock has underperformed its sector and benchmark indices, reflecting persistent challenges in its financial performance and valuation metrics.

Read full news article Announcements

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 - Receipt Of Income Tax Refund

19-Jan-2026 | Source : BSEDisclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 - Receipt of Income Tax Refund

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

14-Jan-2026 | Source : BSEEarnings Call for the quarter and nine months ended December 31 2025

Board Meeting Intimation for Consideration And Approval Of The Unaudited Standalone & Consolidated Financial Results For The Quarter And Nine Months Period Ended December 31 2025.

13-Jan-2026 | Source : BSESubex Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve the Unaudited Standalone & Consolidated Financial Results for the quarter and nine months period ended December 31 2025

Corporate Actions

10 Feb 2026

Subex Ltd has declared 5% dividend, ex-date: 01 Jul 21

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 21 FIIs (0.92%)

None

Uno Metals Ltd (3.41%)

87.11%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 3.78% vs -5.95% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -77.67% vs 172.78% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -4.93% vs -1.24% in Sep 2024

Growth in half year ended Sep 2025 is 247.97% vs 65.08% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -4.83% vs -2.38% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 60.70% vs -771.78% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -7.78% vs 11.13% in Mar 2024

YoY Growth in year ended Mar 2025 is 83.60% vs -274.40% in Mar 2024