Compare Tata Chemicals with Similar Stocks

Stock DNA

Commodity Chemicals

INR 18,062 Cr (Small Cap)

57.00

13

1.56%

0.28

1.65%

0.80

Total Returns (Price + Dividend)

Latest dividend: 11 per share ex-dividend date: Jun-12-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Tata Chemicals Ltd. latest results good or bad?

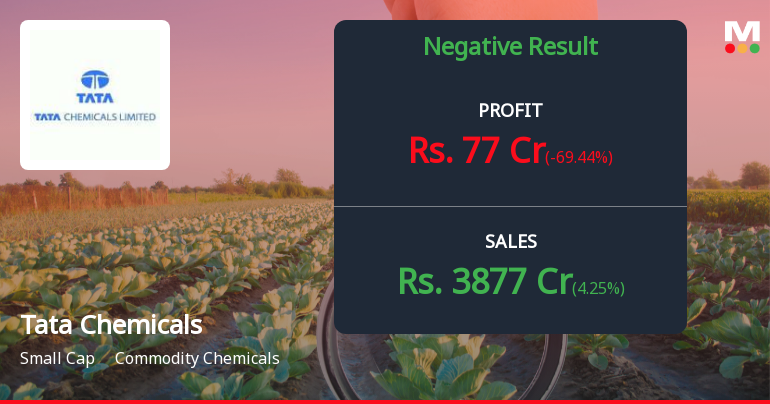

Tata Chemicals Ltd. has reported its financial results for the third quarter of FY26, revealing significant operational challenges. The company experienced a net loss of ₹39 crores, contrasting sharply with a profit of ₹77 crores in the previous quarter. This loss highlights a substantial decline in profitability, driven by a notable contraction in operating margins, which fell to 13.85% from 17.45% in the prior quarter. While revenue showed a sequential growth of 4.25% to ₹3,877 crores, this modest increase was overshadowed by a 17.26% decline in operating profit before depreciation, interest, tax, and other income (PBDIT), which dropped to ₹537 crores. Year-on-year comparisons also indicate a decline in net sales by 3.05% compared to the same quarter last year, alongside a significant reduction in operating profit, which decreased by 13.11%. The company's return on equity (ROE) stands at a weak 5.64%, s...

Read full news article

Tata Chemicals Q3 FY26: Profit Plunge Deepens as Margin Pressures Mount

Tata Chemicals Limited has reported a consolidated net loss of ₹39.00 crores for Q3 FY26, marking a dramatic reversal from the ₹77.00 crore profit recorded in Q2 FY26. The commodity chemicals major, with a market capitalisation of ₹18,430 crores, witnessed its stock decline 2.27% to ₹726.15 following the results announcement, extending a troubling pattern of underperformance that has seen the stock shed 24.71% over the past year. The quarter's results underscore mounting operational challenges, with operating margins contracting sharply despite modest revenue growth, raising serious questions about the sustainability of earnings in the current demand environment.

Read full news article

Tata Chemicals Ltd. is Rated Sell

Tata Chemicals Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 01 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

06-Feb-2026 | Source : BSETranscripts of Analyst/Investors Call pertaining to the Financial Results for the third quarter and nine months ended December 31 2025

Press Release - Investment Of Rs. 515 Crore In New Iodised Vacuum Salt Dried Manufacturing Facility In Tamil Nadu

06-Feb-2026 | Source : BSEPress Release - Investment of Rs. 515 crore in New Iodised Vacuum Salt Dried manufacturing facility in Tamil Nadu

Announcement under Regulation 30 (LODR)-Credit Rating

06-Feb-2026 | Source : BSEIntimation under Regulation 30 (6) read with Schedule III of the SEBI (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Tata Chemicals Ltd. has declared 110% dividend, ex-date: 12 Jun 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 34 Schemes (9.94%)

Held by 162 FIIs (12.26%)

Tata Sons Private Limited (31.9%)

Life Insurance Corporation Of India - P & Gs Fund (9.24%)

23.4%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -8.43% vs 4.25% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -220.78% vs -69.44% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -2.47% vs -5.21% in Sep 2024

Growth in half year ended Sep 2025 is -4.36% vs -64.17% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -2.04% vs -4.75% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -18.90% vs -73.97% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -3.46% vs -8.15% in Mar 2024

YoY Growth in year ended Mar 2025 is -12.31% vs -88.43% in Mar 2024