Compare Uniparts India with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at 0 times

Poor long term growth as Net Sales has grown by an annual rate of -9.30% and Operating profit at -19.16% over the last 5 years

With ROE of 12.6, it has a Very Attractive valuation with a 2.4 Price to Book Value

Increasing Participation by Institutional Investors

Stock DNA

Auto Components & Equipments

INR 2,217 Cr (Small Cap)

19.00

38

7.76%

-0.21

12.61%

2.42

Total Returns (Price + Dividend)

Latest dividend: 22.5 per share ex-dividend date: Oct-23-2025

Risk Adjusted Returns v/s

Returns Beta

News

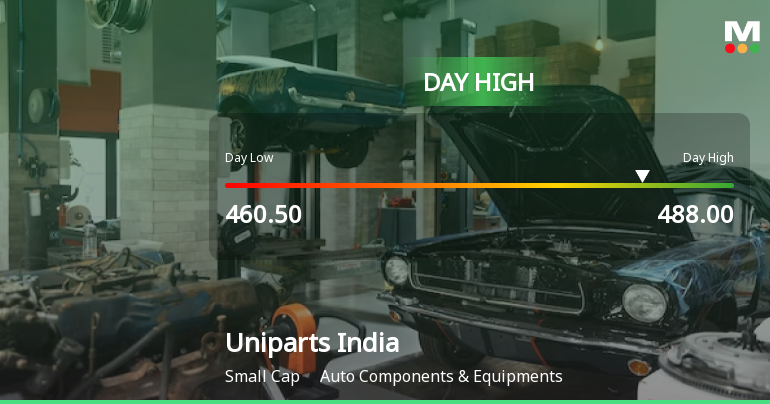

Uniparts India Ltd Hits Intraday High with 9.54% Surge on 3 Feb 2026

Uniparts India Ltd demonstrated robust intraday strength on 3 Feb 2026, surging 9.54% to touch a day’s high of Rs 486.15, significantly outperforming the broader Sensex and its sector peers in Auto Components & Equipments.

Read full news article

Uniparts India Ltd is Rated Hold

Uniparts India Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 16 December 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 02 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Uniparts India Ltd Technical Momentum Shifts Amid Mixed Indicator Signals

Uniparts India Ltd has experienced a notable shift in its technical momentum, moving from a sideways trend to a mildly bullish stance, despite mixed signals from key technical indicators such as MACD, RSI, and moving averages. The stock’s recent price action and indicator readings suggest cautious optimism for investors navigating the auto components sector.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

03-Feb-2026 | Source : BSEEarnings Call Intimation

Board Meeting Intimation for Approval Of (I) Unaudited Financial Results; And (Ii) Declaration Of The Second Interim Dividend And Fixation Of The Record Date For The Same.

02-Feb-2026 | Source : BSEUniparts India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 09/02/2026 inter alia to consider and approve (i) the standalone and consolidated unaudited financial results of the Company for the quarter and nine months ended December 31 2025; and (ii) the declaration of the second interim dividend for FY 2025-26 and fixation of the record date for the same.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

27-Jan-2026 | Source : BSEVoting results of the Postal Ballot along with Scrutinizers Report

Corporate Actions

09 Feb 2026

Uniparts India Ltd has declared 225% dividend, ex-date: 23 Oct 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (1.24%)

Held by 41 FIIs (2.45%)

Gurdeep Soni (19.93%)

Aditya Birla Sun Life Insurance Company Limited (2.47%)

20.35%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 1.16% vs 8.25% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 14.31% vs 50.94% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 9.53% vs -14.88% in Sep 2024

Growth in half year ended Sep 2025 is 60.40% vs -34.33% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -16.33% vs -18.13% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -32.15% vs -39.81% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -15.43% vs -16.58% in Mar 2024

YoY Growth in year ended Mar 2025 is -29.42% vs -39.14% in Mar 2024