Key Events This Week

Jan 27: New 52-week and all-time low recorded at Rs.7.36

Jan 28: Stock hits fresh 52-week and all-time low of Rs.7.33

Jan 29: Minor price stabilisation with a 0.12% gain

Jan 30: Week closes higher at Rs.8.54, up 4.91% on the day

Why is Add-Shop E-Retail Ltd falling/rising?

2026-01-31 00:54:53

Recent Price Movement and Market Context

The stock's 4.91% increase on 30-Jan marks a continuation of a short-term positive trend, with Add-Shop E-Retail Ltd having gained 10.48% over the last three trading sessions. This outperformance is particularly significant when compared to its sector peers, as the stock outpaced the sector by 5.39% on the day. Such momentum suggests a growing confidence among investors, possibly driven by technical factors and increased trading activity.

However, this short-term rally contrasts with the stock's broader performance metrics. Over the past week, Add-Shop E-Retail Ltd has delivered a modest gain of 2.28%, slightly better than the Sensex's 0.90% rise. Yet, over the one-month and year-to-date periods, the stock has declined by 3.72% ...

Read full news article

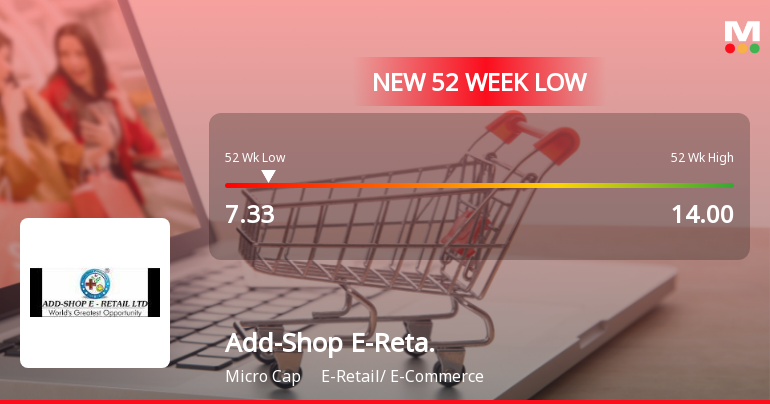

Add-Shop E-Retail Ltd Stock Falls to 52-Week Low of Rs.7.33

2026-01-28 10:03:23Add-Shop E-Retail Ltd’s shares touched a new 52-week low of Rs.7.33 today, marking a significant decline amid persistent underperformance relative to its sector and benchmark indices. The stock has now fallen for two consecutive sessions, registering a cumulative loss of 7.78% over this period, while continuing to trade below all key moving averages.

Read full news article

Add-Shop E-Retail Ltd Stock Falls to 52-Week Low of Rs.7.33 on 28 Jan 2026

2026-01-28 10:03:11Add-Shop E-Retail Ltd has touched a new 52-week and all-time low of Rs.7.33 today, marking a significant decline amid ongoing challenges in the e-retail sector. The stock has underperformed its sector and benchmark indices, reflecting persistent headwinds and subdued financial metrics over recent quarters.

Read full news article

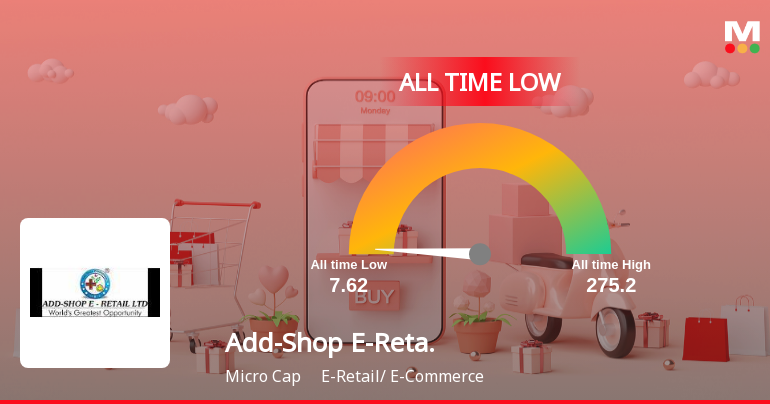

Add-Shop E-Retail Ltd Stock Hits All-Time Low Amid Prolonged Downtrend

2026-01-28 09:33:55Add-Shop E-Retail Ltd has reached a new all-time low of Rs.7.33, marking a significant milestone in its ongoing decline. The stock’s recent performance highlights persistent difficulties within the company’s financial and market standing, as it continues to underperform its sector and benchmark indices.

Read full news article

Add-Shop E-Retail Ltd Stock Hits 52-Week Low Amid Continued Downtrend

2026-01-27 18:01:28Add-Shop E-Retail Ltd’s shares declined sharply to a new 52-week and all-time low of Rs.7.36 on 27 Jan 2026, marking a significant downturn for the e-commerce company amid persistent underperformance and subdued financial results.

Read full news article

Add-Shop E-Retail Ltd Stock Hits All-Time Low Amid Continued Downtrend

2026-01-27 14:17:35Add-Shop E-Retail Ltd has reached an all-time low, continuing its extended period of underperformance within the E-Retail sector. The stock’s latest decline of 4.31% on 27 Jan 2026 marks a significant milestone in its downward trajectory, reflecting persistent challenges in financial metrics and market valuation compared to benchmarks and peers.

Read full news article

Add-Shop E-Retail Ltd Downgraded to Strong Sell Amid Weak Fundamentals and Bearish Technicals

2026-01-07 08:24:26Add-Shop E-Retail Ltd has been downgraded from a Sell to a Strong Sell rating as of 6 January 2026, reflecting deteriorating technical indicators, flat financial performance, and persistent underperformance relative to the broader market. Despite an attractive valuation on some metrics, the company’s weak long-term fundamentals and bearish technical trends have compelled analysts to revise their outlook sharply downward.

Read full news article

Add-Shop E-Retail Ltd Upgraded to Sell on Technical Improvements Despite Lingering Fundamental Challenges

2026-01-02 08:18:55Add-Shop E-Retail Ltd has seen its investment rating upgraded from Strong Sell to Sell as of 1 January 2026, driven primarily by a shift in technical indicators despite ongoing fundamental challenges. The company’s technical trend has improved from mildly bearish to sideways, prompting a reassessment of its outlook. However, the firm continues to face flat financial performance and long-term operational headwinds, which temper enthusiasm for a stronger upgrade.

Read full news article