Banking in India is a proxy for the underlying consumer growth and economy. Despite the recent spate of bad news in Axis, PNB and ICICI Bank, the better run banks in the sector will remain to be great investment bets offering both the safety of size and strong underlying fundamentals. In this Marketsmojo Professional Exclusive, I try and find the best banks to bet on.

In my last piece, I talked about the Banking Sector and how the Valuation differential between the Private and PSU Banks are justified. But does this analysis hold up when we look at individual banks? Also, can it help us find the best investment ideas in the banking sector?

As the American screenwriter, director, producer, Joss Whedon said “Absolutely eat dessert first. The thing that you want to do the most, do that.” So here is the list of the best Investment ideas.

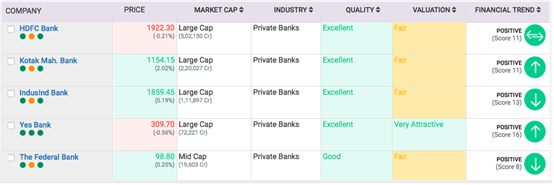

|

There are no PSU Banks that figure in this list, probably not a surprise.

Interestingly two banks in the News: ICICI Bank and Axis Bank don’t make the cut either!

How did I arrive at this list?

Here is a Step by Step Analysis to arrive at this list using the MojoExpert Screener.

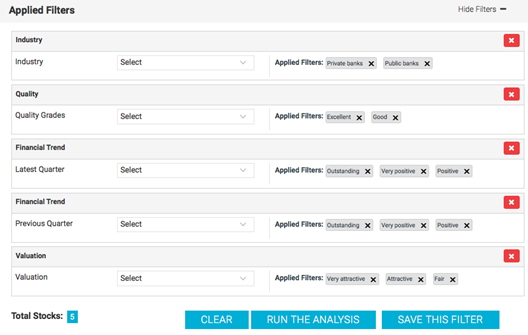

I have applied the following filters:

- Industry is Private Banks and Public Banks

- Quality Grade is Excellent and Good

- Financial Trend for the Latest Quarter is Outstanding, Very Positive and Positive

- Financial Trend for the Previous Quarter is Outstanding, Very Positive and Positive

- Valuation is Very Attractive, Attractive or Fair

Now to continue the discussion from my last piece. In that I had shown why the difference between the Valuations of Private Banks and PSU Banks is justified. How do the individual banks stack up?

Method in the Madness… 2

I had mentioned that the three main drivers of Valuation of a Bank are:

- Profitability

- Risk

- Growth Prospects

Also, the best measure of Valuation for Bank is Market Cap to Book Value (or Price to Book, P/B in short)

Let us look at how the individual banks stack up.

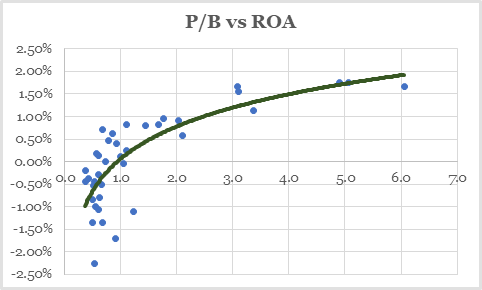

Profitability is best measured by Return on Assets (ROA). Simple logic suggests that higher the Profitability higher should be the valuation. Thus, P/B should be higher for banks that have higher ROA.

The data confirms the hypothesis. P/B is higher for banks with higher ROA. But interestingly this relationship is non-linear.

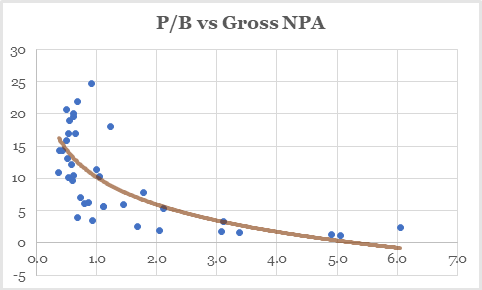

The best proxy of Risk, as mentioned is the historic Gross NPA. Logically, banks with lower Risk should get a higher valuation.

Again, the data confirms the hypothesis. P/B rises for lower Gross NPA. Again, like in the previous case, the relationship is non-linear.

Our Mojo analysis takes into account all these factors, including the non-linearity of the relationship, to arrive at the Valuation of a bank.

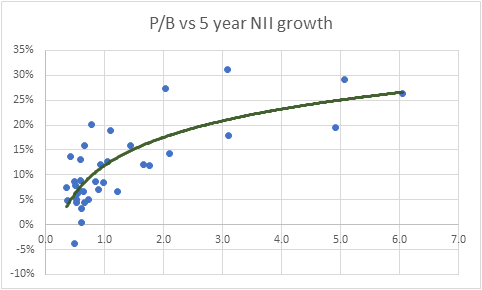

Growth Prospects require forecasting and it is very difficult to forecast. Based on the current situation it seems that the Private Banks should do better than their PSU counterparts. However, I have taken the last 5 Year growth in Net Interest Income as a proxy for the future growth.

Banks with higher Growth prospects should have higher Valuation.

The data confirms the relationship between P/B and NII growth. The relationship, like the other two, is non-linear.

Ok, so we have once again established that there is a Method in the Madness.

A data driven approach which manages to capture the “Method” is what we use to arrive at the simple results that you see above.

Would love to hear your feedback.

Sanjeev Mohta

Market Expert

Sanjeev Mohta is the Market Expert at Marketsmojo. He has over 27 years’ experience in Investment Research and Fund management across Asian Markets and Asset classes. He has worked in various organisations in Singapore and India like Alchemy, QVT, Jefferies, ABN Amro and HSBC Securities. He Has a PhD in Economics from Tulane University, USA.